Unparalleled Ability in Both Financial & Physical Commodity Trading

“Quor’s solution has brought tangible benefits to our metals trading business. We have substantially reduced our costs since implementing the Quor system and additional savings have been realized as a result of further internal development combined with Quor’s add-on functionality.”

- Kevin Brunton, CIO, Koch Supply & Trading

“Eka is the single most critical business support application being used at Boliden currently.”

- Finance Director, Boliden

Asset Classes

Base Metals

The term is used to refer to industrial non-ferrous metals excluding precious metals. Base metals serve many purposes and are relatively inexpensive.

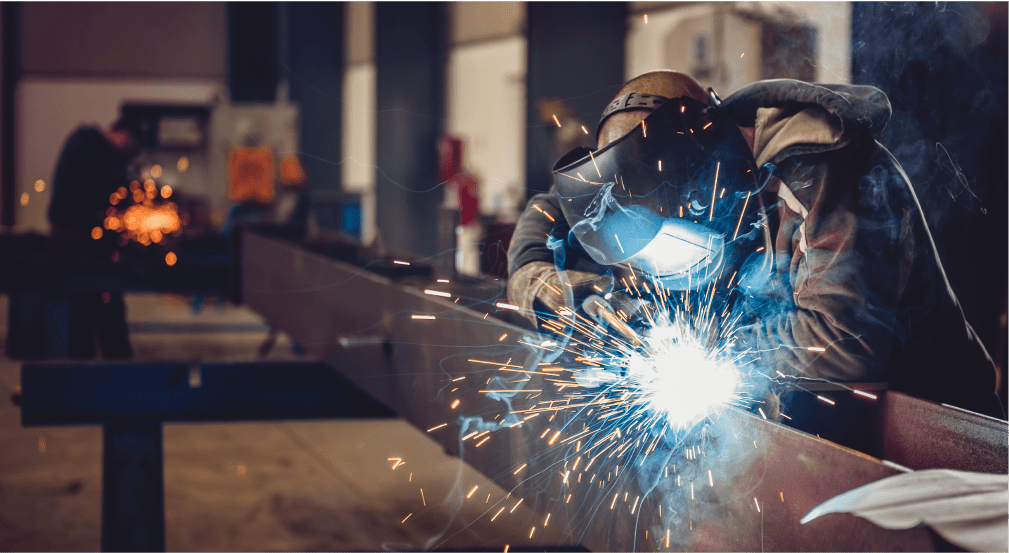

Scrap

A product including both ferrous (iron-based) and nonferrous metals that have become worn out or is off-specification and is recycled to recover its metal content, or metal pieces generated from machining operations and recycled to recover their metal content.

Steel

Durable metal alloy made up of iron and carbon available in more than 3,500 different grades. Theses variations differ in physical, chemical, and environmental properties.

Concentrates

Concentrates are a fine, powdery product of the milling process where gangue (waste) is removed, resulting in a high percentage of valuable metal.

Precious Metals

Rare, naturally occurring metallic elements known for their high economic value. Precious metals, including gold, silver, platinum, and palladium, have unique properties such as resistance to corrosion, electrical conductivity, and distinct lustre. Often used in jewellery, electronics, and as investment assets due to their stability and limited supply.

Explore Trinity

Trinity covers trading lifecycle processes for companies engaged in metals and agricultural commodities trading. Our technology excels in hedging and risk management and supports a wide range of contracts from forwards, futures, options and averages to complex derivatives.

Explore Fintrade

Quor enables companies to increase margins, take advantage of opportunities arising from market volatility, and reduce operating costs. Speak to the team today on how Quor can improve financial trading and risk mitigation, physical trading, trading and trade operations, cash flow management, inventory management, logistics management, ordering, and trade finance.

Trusted By 100+ Global Businesses

Producing

Commodity prices are a volatile force in the business world, making it difficult to plan for future costs and allocate resources. Quor can help analyze how these changes affect stocks and can be an invaluable asset when navigating market uncertainty.

- With prices of commodities rapidly changing, it can be challenging for businesses to anticipate costs and allocate resources appropriately.

- Analyzing the transformation of goods and the impact on stock value offers invaluable insight.

- For Oleaginous and Concentrates products the ability to precisely trace content like assays or oils allows accurate pricing and position.

Trading

Quor unlocks potential for physical traders by offering full visibility into their metals products. By combining physical contracts and financial hedging instruments, we help you understand positions, risks and profits in an efficient way – maximizing performance from any trading activity.

- Navigating trading raw materials is complex; setting the right price, securely delivering goods, and managing risk exposure are priority considerations.

- From wild swings in daily costs to waiting on the unpredictable nature of the industry, businesses confront an ever-changing marketplace.

- Ensuring traders are reconciled is essential for a comprehensive understanding of risk exposure across the entire lifecycle of the trade.

Inventory & Logistics

Edge out the competition by streamlining costs with Quor’s CTRM and commodity management platform. Get a clear view of all your trades and monitor progress in real time to stay one step ahead of potential pitfalls.

- Commodity trading requires costs to be tightly controllled – our CTRM and Commodity Management system provides an easy-to-use solution.

- Keeping track of trades as it progresses is vital; Fintrade helps you check statuses with ease.

Risk Management

With commodity derivatives hedging and trading, businesses face an array of risks that could threaten legality or compromise financial stability. These include ever-changing price risk, counterparty risk, operational pitfalls, plus regulatory uncertainties due to constantly evolving regulations at all levels.

- Trading commodity derivatives carries substantial risk of exposure to price fluctuations—a challenge that requires vigilant monitoring and strategic decision-making.

- It’s vital to evaluate the creditworthiness of your counterparty in order to avoid potential defaulting risks.

- From catastrophic systems outages to insidious data breaches and simple human error, operational failures can wreak havoc on portfolios.

- Trading in commodity derivatives is a tightly controlled space, where the consequences of failing to follow regulations can be severe.

Hedging

Everyday presents a new challenge – bringing together disparate data from around the globe to paint an accurate, up-to-date picture of both physical and derivative positions that helps the decision-making process around complex hedging instruments.

- Hedging a commodities position requires finesse and precision to strike the right balance between controlling risk and averting excessive expenses.

- Protecting yourself from market uncertainty by choosing the best hedging instruments to safeguard your position is essential.

- Carefully responding to the market and making adjustments, such as rolling over contracts, is key when hedging a commodities position.

- Hedging offers the possibility of reducing uncertainty but carries its own complexities; namely costs, rigidity and the threat of losses.

Accounting

Keeping up with financial transactions and regulations can be a daunting task for any company whether accounting for financial or physical trading and hedging. Quor uses careful analysis techniques the help clients adhere to rigorous regulatory filings, ensuring that fair market value is accurately reflected on every statement they produce.

- Financial statements must reflect the fair market value of derivatives, this requires sophisticated valuation techniques including discounted cash flow analysis.

- A trading company must maintain timely accuracy when it comes to the trade data that impacts their accounting processes.

- Financial statements must provide a comprehensive overview of transactions, diving into the specifics of a contract’s nature and risks.

- Companies must adhere to regulations when accounting for derivatives transactions. This can involve report filings, capital reserve guideline.

Treasury

Keeping a business afloat requires more than just money; it also requires a financially savvy team. Understanding the company’s cash flow and managing exposure to interest rate risk are essential tasks of keeping any organization secure financially.

- Cash flow is the lifeblood of business, yet it can be difficult to get a clear picture of it when trading.

- The treasury function is responsible for the company’s exposure to interest rate risk, which requires constant monitoring to ensure security.

Achieve Better Business Outcomes

Understand more about our approach and how we work across the commodities lifecycle to drive success

Quor’s system supports Koch’s entire financial trading lifecycle from trade entry to settlement and client ledger balances.

Understand more about Fintrade and gaining a competitive edge in your trading activities

With over 30 years’ experience of delivering multi commodity trading, risk and logistics solutions to leading global…